In case of Frost we need to estimate operating cash flows and then work out PCF as follows. EBIT profit from the main activity ie the amount of the companys profit before taxes and interest.

Price To Cash Flow Ratio P Cf Formula And Calculation

A ratio of 030 30 is quite good Corys Tequila Co.

. Cash Return On Assets Ratio. Free Cash Flow 227 million 32 million 65 million 101 million. The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations.

Price to Operating Cash Flow Current Market Price Operating Cash Flow. T the amount of income tax. The numerator market capitalization is the total value for all stocks outstanding for a company.

Terms in this set 8 Cash Flow From Assets Cash Flow to Creditors. PCF dfrac Price. However to find out this ratio we need to calculate cash flow per share.

We can apply the values to our variables and calculate Cash Flow to Sales Ratio. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets. Cash flow per share Cash Flows from Operating Activities Weighted-Average Number of Shares 30 million 2 million 15 per share.

This ratio is super useful for investors as they can understand whether the company is over-valued or under-valued by using this ratio. Price to Cash Flow Share Price Cash Flow per share. Market cap can typically be found with many stock quotes along with other common stock metrics.

This results in the following cash flow from assets calculation. Price to Free Cash Flow Current Market Price Free Cash Flow. Cash Flows from Operations Net Income Non-cash Items 20 million 5 million 25 million Cash Flow per Share 25 million 5 million 5 per share Price to Cash.

Cash flow is often overlooked when people analyze a company. Cash Return On Assets Cash Flow From Operations CFO. That means in a typical year Randi generates 66000 in positive cash flow from her typical operating activities.

Price to Cash Flow Ratio Formula. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. Cash Flow to Sales 136200000 11600000 350400000.

Price to Cash Flow Share Price or Market Cap Operating Cash Flow per share or Operating Cash Flow The PCF ratio equation can also be calculated using the market cap like this. This ratio is super useful for investors as they can understand whether the company is over-valued or under-valued by using this ratio. Thus if the price to cash flow ratio is 3 then the investors are paying 3 rupees for a.

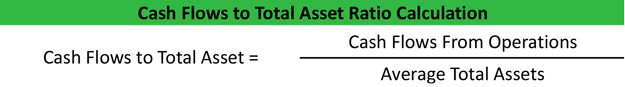

85000 0 9000 -10000 66000. It relates a companys ability to generate cash compared to its asset size. Cash flow from operations can be found on a companys statement of cash flows Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period.

The price to cash flow ratio tells the investor the number of rupees that they are paying for every rupee in cash flow that the company earns. Shouldnt run into any problems. Operating cash flow formula is represented the following way.

You can be a profitable company but if you dont have cash moving around to pay bills then you are really in trouble. Price to Cash flow Ratio Current Stock Price Cash Flow per Share 50 15 333. P C F P r i c e p e r S h a r e O p e r a t i n g C a s h F l o w p e r S h a r e.

Lets assume that the average 30-day stock price of company ABC is 20within the last 12 months 1 million of cash flow was generated. Price to Cash Flow Ratio Share Price Cash Flow Per Share As you can see to calculate the price-to-cash-flow ratio you merely take the price per share of a. The price to cash flow ratio is a pretty straightforward calculation.

The formula for calculating the operating cash flow ratio is as follows. Alternatively the formula for cash flow from operations is equal to net income. You can easily calculate the price to cash flow ratio by using the following formula.

The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations. This is operating cash flow formula. The Price - Cash Flow Ratio Formula The PCF ratio is the market price per share divided by the cash flow per share.

Free Cash Flow 93 million. OCF EBIT DA-T where. Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018.

If a company has an operating income of 30000 5000 in taxes zero depreciation and 19000 working capital its operating. Operating cash flow is mentioned in the cash flow statement of the annual report. The Price to Cash Flow ratio formula is calculated by dividing the share price by the operating cash flow per share.

The Price - Cash Flow Ratio Formula The PCF ratio is the market price per. DA deductions for depreciation and amortization. Randis operating cash flow formula is represented by.

CFO Enterprise Yield Cash Flow From Operations CFO Enterprise Value EV When comparing similar companies a higher yield would indicate a better value than a lower yield 2. In this case Whimwick Studios would have a Cash Flow to Sales Ratio of 35 for 2019.

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Cash Flow From Investing Activities Overview Example What S Included

Cash Flow Formula How To Calculate Cash Flow With Examples

1 J 23 I E U This Document Kee Cash Flow Statement Knowing You Sales Revenue

Cash Flow Statement Templates 14 Free Word Excel Pdf Cash Flow Statement Statement Template Personal Financial Statement

How To Calculate Ebitda Cash Flow Statement Financial Analysis Financial Analyst

What Does Price To Cash Flow Indicate Positive Cash Flow Cash Flow Financial Analysis

Cash Flow Ratios Cash Flow Cash Investing In Stocks

Financial Statements Financial Accounting Economics Lessons Financial Statement

Formula For Cash Flow Economics Lessons Bookkeeping Business Accounting

Impairment Cost Meaning Benefits Indicators And More Money Management Advice Accounting And Finance Bookkeeping Business

Cash Flow From Operating Activities Learn Accounting Accounting Education Cash Flow

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Common Financial Accounting Ratios Formulas Financial Analysis Financial Accounting Accounting

Example Cash Balance Reconciliation Alphabet Inc Cash Flow Statement Cash Flow Reconciliation

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow From Investing Activities Small Business Accounting Accounting Financial Statement

What Is Cash Flow On Total Assets Ratio Definition Meaning Example

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Financial